About

Polaris Real Estate Partners acquires multifamily properties throughout the U.S. Our goal is to enhance the living experience and enrich the lives of our most valuable asset – the residents who choose to live at our communities.

The general partners of Polaris have collectively in excess of 50 years in ownership and management of income producing properties and have been investing continuously for 28 years. We have acquired approximately 7,138 units as part of our existing portfolio and own multifamily real estate assets in Kansas, Missouri and Texas. The principals have invested successfully in 21 commercial real estate markets in 14 states.

Mission

Vision

Communities

We feel that we have a responsibility to foster a sense of community at our properties. We leverage the existing amenities at our properties, and add additional amenities whenever possible, to provide a satisfying tenant experience.

News

Polaris Hosts Valentine’s Day Celebration

Polaris celebrated this Valentine's Day with a heartwarming community-wide event. The management team at Polaris created a memorable occasion for residents, ensuring a delightful experience for all. The properties’ leasing offices and clubhouses were decorated with...

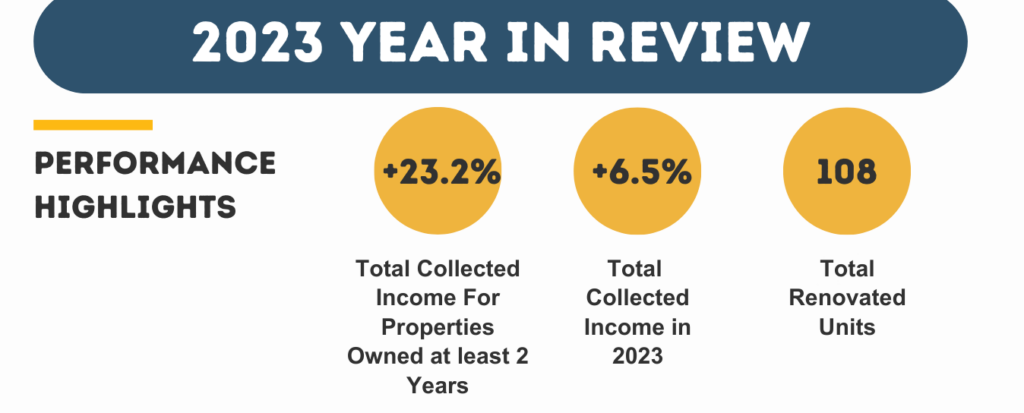

2023 Review and 2024 Outlook

San Francisco, CA (January 2024) – Polaris Real Estate Partners (“Polaris”) is pleased to share the achievements of 2023 and outline its plans for 2024. The past year included team expansion and portfolio income growth. We remain committed to enhancing residents'...

TURKEYS AND FOOD GIVEAWAY DURING THANKSGIVING AT POLARIS PROPERTIES

Dallas, TX (Dec. 2023) – Embracing the spirit of gratitude this Thanksgiving, Polaris Real Estate Partners (“Polaris”) held heartwarming food giveaways across all of its properties to express sincere appreciation to its residents. On Thanksgiving Day, onsite...

NEW SERVICE CENTER LAUNCHED AT PACIFICA APARTMENT HOMES

Dallas, TX (Nov. 2023) – Polaris Real Estate Partners (PREP) was thrilled to celebrate our recent launch of our brand-new career site at our Pacifica Service Center in October, along with an exciting Family Fun Day event! This collaboration with the South Dallas...

POLARIS REAL ESTATE PARTNERS’ 2023 ANNUAL SCHOOL BACKPACK GIVEAWAY

SAN FRANCISCO, CA (AUGUST 2023). Polaris Real Estate Partners (PREP) proudly continues our annual back-to-school backpack giveaway tradition this year. We are delighted to share that we distributed a total of over 1,000 backpacks, the largest number we have given...

POLARIS COMMUNITY UNVEILS EXCITING SUMMER ACTIVITIES FOR THEIR RESIDENTS

SAN FRANCISCO, CA (July 2023) — Polaris Real Estate Partners (PREP) is thrilled to announce a series of engaging summer activities designed for our residents. This promises to be full of fun, learning, and community building for everyone at our properties. “Safety...